Nearly 48 million Americans quit their jobs in 2021. Through the first five months of 2022, 20 million Americans did the same. The Great Resignation is playing out across the economy and it’s not over; globally, one in five workers are expected to quit before the end of the year. People in all industries are reprioritizing things and in a hot job market are able to explore their options, so quitting isn’t as scary as it once seemed.

The promotional products industry is not immune from this trend and like any other sector, can suffer if it doesn’t respond. Businesses across the field are implementing new policies, seeking new talent and working to better connect with their employees, while promo professionals are weighing the directions open for their careers.

The Great Resignation and the trends driving it are felt as readily in a marketplace as large and diverse as the promotional products industry as any other sector of the economy. “Employees know what they want and need to be happy,” says Erika Ruehlman, vice president of talent and strategy at St. Louis-based PromoPlacement Recruiting. “Companies that are taking a modern approach to work-life balance, remote work, benefits and are being competitive with compensation are winning by attracting and retaining top talent. One hundred percent of the people I talk to love the industry with a passion I believe to be unrivaled.

“Employees know what they want and need to be happy,” says Erika Ruehlman, vice president of talent and strategy at St. Louis-based PromoPlacement Recruiting. “Companies that are taking a modern approach to work-life balance, remote work, benefits and are being competitive with compensation are winning by attracting and retaining top talent. One hundred percent of the people I talk to love the industry with a passion I believe to be unrivaled.

“Companies must step up their game to hire and retain the ‘A players,’ and those that do will come out on top.”

Businesses large and small have registered key talent departures. In February, Jason Lucash stepped down from his position as chief development officer at Braintree, Massachusetts-based supplier HPG. He still serves on the company’s board in an advisory capacity and sees many of The Great Resignation’s trends at play in the industry.

“During the pandemic the labor force shifted dramatically,” Lucash says. “Many people were out of jobs and receiving the high unemployment benefits associated with it, so they didn’t want to return to the labor force, and that hasn’t changed dramatically in the last two years.

“The biggest impact these trends will have on the industry is for suppliers in the operations side of their business. Just as the airlines currently can’t handle the amount if bags passing through airports every day due to staffing shortages, the same is to be said about suppliers in the promo industry. When you layer on increased demand, with labor shortages to decorate and ship orders, it makes for the perfect storm. Also, as many more remote work opportunities opened up during the pandemic, the typical warehouse employee now had a much larger pool to select jobs from which further exacerbates the staffing shortages.”

No organization is immune to the effects of this unfamiliar economic paradigm. Even PPAI has been affected. It has registered a handful of veteran contributors parting ways with the Association in recent years as they move on to new chapters in their lives. High profile departures within the organization include Director of Publications and Editor Tina Filipski, who stepped down at the end of 2021 after 26 years, and Executive Vice President Bob McLean, who left last month after a 14-year run to enter consulting work. In 2021, McLean led the Association in an interim capacity following the departure of Paul Bellantone from his post as president and CEO for an executive role at leading distributor HALO.

Regardless of how long The Great Resignation and the trends behind it remain in play, it will likely have a lasting effect on how promotional products companies’ recruiting and retention practices.

“Human resource professionals are noting a delineation in resignations between companies that offered remote work opportunities versus those that enforced a return to the office,” says Jaci Badzin, a business futurist who has worked with NIKE, Google and YouTube. “While some positions and teams strongly benefit from a return to the office, work from home flexibility, even part time, proves to currently be one of the most important policies for retaining and attracting top talent and entry level talent.

“The other big area is healthcare benefits. Increasing and publicizing stellar healthcare policies is one of the best ways companies can attract great talent. We even see employees sharing about their great benefits on social media. Benefits that stand out can include mental health support, holistic medicine benefits, and fertility and family planning.”

McKinsey has grouped those that leave their jobs during the Great Resignation into three broad groups:

- Almost half (48%) of those who quit are going to positions in different industries. And this isn’t affecting all industries in the same way—talent is draining excessively from some and others are challenged to bring in new workers. Some sectors have both problems.

- Many employees who quit go into nontraditional roles like gig or part-time work or start their own businesses. While about half (47%) return to the workforce, only 29% resume full-time work in the traditional sense.

- Some leave the workforce to focus on other areas of their lives—caring for children or elderly, or even themselves. This group may have stepped out of the labor pool entirely.

Ruehlman notes that promotional products field workers typically don’t want to leave the industry. She says, “I think they would fight long and hard to stay in it before attempting to look elsewhere. Sadly, those that do look outside of the industry tend to feel like that may be one of the only ways to reach the compensation they desire. I have noticed many of the people that were forced to leave the industry due to pandemic-related layoffs are now looking to return. Many are willing to even take a step back from their previous role to be able to achieve that.”

- Responses were similar across all parts of an organization: front-line staff (36%), managers (34%), directors (32%) and executives (33%).

And the Great Resignation and the attitudes behind it are likely to remain a factor for a while. A survey by AI-drive job search platform Joblist found that 42% of those who quit and found new jobs say the new positions aren’t living up to their expectations. This group is unlikely to stick around at a job that isn’t working for them.

- The survey found that 16% will stay at a job not meeting their expectations for three months or less, 34% for less than six months and 48% will stay less than a year.

- Worker age can exacerbate these numbers—47% of people in their 20s and 40% of those in their 30s say they will leave a job that doesn’t measure up in six months or less. However, less than 25% of those over the age of 40 will leave in less than six months.

- Meaning: PwC’s poll found that following compensation, finding a job fulfilling (69%), working at a place where one can truly be themselves (66%) and a feeling that the team cares about their well-being (60%) were top drivers in the decision to seek new employment.

- Confidence/Competence: Employees want to feel that they can be creative/innovative at their job (60%) and that they can exceed what is expected of them in their role (58%).

- Autonomy: Employees want to control when they work (50%) and where they work (47%).

- Results show that 65% “agree” or “strongly agree,” 17% “neither agree or disagree,” and 19% “disagree” or “strongly disagree.”

- Quizzing participants on burnout, it found that 45% experience burnout “often or extremely often,” 31% experience it “sometimes” and 24% experience it “rarely” or “not at all.”

- Even among “burned out” employees, appreciation goes a long way—19% of employees who face “chronic workplace stress” but also feel that they are valued on the job are planning to leave, compared to 65% who don’t feel valued.

“Every major company has stated brand values, often on their ads or company homepage,” Badzin says. “For example, Apple’s company motto is ‘Think Different’ while Disney’s is ‘The Happiest Place on Earth.’ If a company is struggling with retention one first step is to put their efforts into creating a culture that truly brings a brand’s values to life. Employee experience matters.”

Following the pandemic rebound, employment growth has been rapid—in July, the U.S. unemployment rate fell to 3.5% and the country added 528,000 nonfarm jobs, in part fueled by a voluntary turnover rate up 25% from pre-pandemic levels. Additionally, there were 11.3 million open jobs at the end of May, according to the U.S. Bureau of Labor Statistics. This is up from 9.3 million open jobs at the end of April 2021.

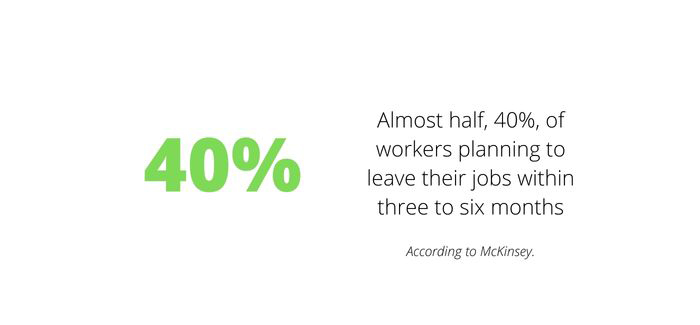

One thing that hasn’t changed since 2021, according to McKinsey, is the percentage of workers planning to leave their jobs within the next three to six months—40%.

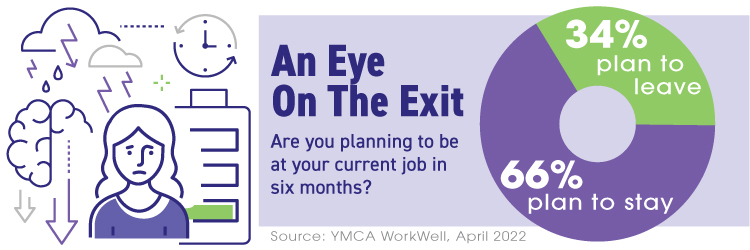

Aligning with McKinsey’s findings, an April survey by YMCA WorkWell, a workplace well-being expert for businesses, governments, and non-profits, asked 682 employed adults if they intend to be working at their current organization in six months. It found that 34% of respondents were expecting to leave or open to leaving their current role in the next six months.

As in so many other sectors of the economy, the Great Resignation has brought new faces to the promotional products industry, familiar faces to new corners of it and in some cases departures. Lucash recognizes many of the factors influencing the Great Resignation in his decision to step down from his role at HPG.

Lucash recognizes many of the factors influencing the Great Resignation in his decision to step down from his role at HPG.

“I was working crazy hours for 13 years straight, traveling 150,000+ miles a year and prioritizing work before everything,” says Lucash. “When the pandemic hit and I was suddenly home and not in the office or on the road it was quite the adjustment. Over the two years of being grounded and working from home, it made me re-prioritize what was the most important to me. I wanted to spend more time at home with my family, take a break from working to reevaluate what I am passionate about and spend more time figuring out where I can make my next big impact.

“All of the factors led to my decision to leave HPG, and I think a lot of people have had similar thoughts and experiences fueled by the pandemic.”

Kim Bakalyar, CAS, formerly the chief compliance officer and director of vendor relations at Los Angeles-based distributor PromoShop and PPAI’s 2022 Woman of Achievement, retired earlier this summer. While the trends at play in the industry did not influence that decision, they did reinforce it. “If anything,” she says, “the pandemic made me more certain that it was the right time for me to take a step back and give myself permission to slow down a little.”

Kim Bakalyar, CAS, formerly the chief compliance officer and director of vendor relations at Los Angeles-based distributor PromoShop and PPAI’s 2022 Woman of Achievement, retired earlier this summer. While the trends at play in the industry did not influence that decision, they did reinforce it. “If anything,” she says, “the pandemic made me more certain that it was the right time for me to take a step back and give myself permission to slow down a little.”

However, Bakalyar would not be alone if the pandemic had been a factor in her retirement. Data from investment management company Vanguard suggests that in 2020-2021, the pandemic prompted an additional 1.6 million retirements among workers 55 and older.

Industry companies report interest in open positions at the firms but are moving to accommodate the increase in mobility among the workforce at larger.

“In 2022, our employee retention has improved with our attrition rate falling by almost 50%,” says Leonid Rozkin, CEO of Dallas-based service platform provider OrderMyGear (PPAI 704581). “We have seen a decrease in the number of external applicants applying for our open positions and believe it is because of the current employment state of the economy. We are always hiring and find it important to hire and promote from within, when possible, to create opportunities for career growth and personal development.

“We’ve also adjusted our talent sourcing to connect directly with the community and potential candidates in smaller, often face-to-face settings like college job fairs.”

Chris Anderson, CEO of HPG, says, “The changes first manifested a few months into the COVID-19 pandemic. We have witnessed a continued trend of increasing employee mobility driven partially by the work-from-home phenomenon, and partially by high demand for talent in certain areas of our enterprise—such as technology.”

There is also a more open attitude toward new opportunities. Ruehlman says, “Interestingly the biggest shift I have seen is in the passive candidate market, meaning people are far more open to hearing about what’s available but not necessarily aggressively searching on their own. Those candidates are generally not willing to jump unless the new opportunity checks all the boxes both professional and personally.”

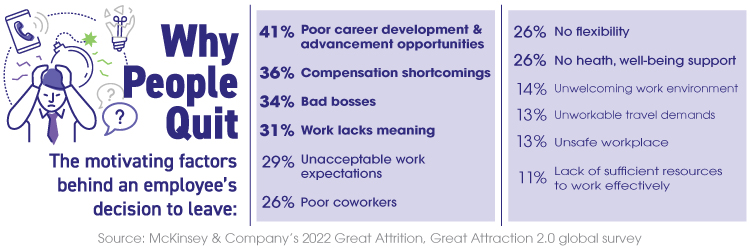

In its 2022 Great Attrition, Great Attraction 2.0 survey, McKinsey measured the top reasons respondents gave for quitting their job in the April 2021-April 2022 time period. The most commonly given reason was the lack of career development and advancement (41%), followed by inadequate total compensation (36%) and uncaring and uninspiring leaders (34%). PwC reported similar findings. Its Global Workforce Hopes and Fears Survey, polling more than 52,000 workers in 44 countries and territories, and conducted in March, highlighted salary’s role in workers’ decisions. It found that, by and large, pay is the big reason driving the decisions to change jobs—71% of those surveyed cited it as a main factor.

PwC reported similar findings. Its Global Workforce Hopes and Fears Survey, polling more than 52,000 workers in 44 countries and territories, and conducted in March, highlighted salary’s role in workers’ decisions. It found that, by and large, pay is the big reason driving the decisions to change jobs—71% of those surveyed cited it as a main factor.

However, it also identified three additional issues that were part of employees’ decisions as to whether they or not they change their working environment.

These motivations are reflected in promo industry workers’ own decisions.

“Ironically the main reason I see for people wanting to make a change is that companies are understaffed,” Ruehlman says. “Support people are feeling overworked and stressed out. On the sales side business is booming again, but staff was likely cut during the pandemic and not replaced. Salespeople are feeling the stress of taking on many of the support tasks which take away time from selling and their bottom line.

“I think everyone is feeling burnout from the extra effort it took to survive the last couple of years and now looking for relief. If they don’t see their company making the effort toward correcting that, then they are looking.”

YMCA WorkWell’s survey looked closer at employees’ decisions to leave and found that their sense of well-being can play a significant factor. The organization’s earlier research, the 2021 YMCA WorkWell Workplace Well-Being Report, identified workload and burnout as clear challenges to employee well-being going into 2022, and its most recent survey identified a similar trend.

YMCA WorkWell asked survey respondents to share their reaction to the statement “Thinking back on the last three months, I feel as though my workload has been a significant source of stress for me in my role.”

Among those considering leaving their job, almost half, 44% described themselves as burned out.

The Great Resignation has driven many businesses to reexamine what they offer their employees. Workplace flexibility, meaningful work and support for health and well-being were some of the most powerful draws for employees in McKinsey’s survey, for example.

YMCA WorkWell suggests that turnover risks drop substantially when an employee feels appreciated. Only 15% of employees who feel appreciated at work are looking to leave their positions in the next six months.

“The Great Resignation has sharpened our focus on the holistic value proposition of choosing to work for HPG,” says Anderson. “Whether it be increased benefits—such as a generous health insurance and retirement plans—or hybrid/work-from-home flexibility, we continue to evolve to meet the changing needs and expectations of our team members.”

HPG is not alone in assessing what it offers its employees. OrderMyGear is working to better understand its employees’ motivations, what drives them to stay at the company and their perspectives on areas of opportunity.

“We’ve accomplished this by gathering their perspectives through monthly surveys and interviews,” says Rozkin. “This helps us get ahead of matters before they become issues.”

Earlier in 2022, OrderMyGear provided raises approximately three times its normal budgets and put career pathing and coaching/development plans in place. Rozkin says, “This helps us ensure there’s proper career pathing for roles across the organization so employees are clear on what’s next and what it will take to get there. We have also continued to invest in our culture and build a strong sense of community through employee-led culture events, company-wide events like office Olympics, and encouraging people leaders to get outside of the office with their teams, like lunches and group activities.”

Company culture and its role in connecting and attracting talent is worth the scrutiny. Evidence from YMCA WorkWell, McKinsey and elsewhere suggests that a positive organizational culture can also reinforce an employee’s relationship with their employer.

“Companies that thrived through the Pandemic and beyond have recognized the vital need to put employee well-being and experience at the center of company culture,” says Badzin. “We will see a dramatic shift away from ‘perks’ like unlimited free snacks, in-office massage and ping-pong tables. Employees are showing with their choices that they want a company that has respect-driven policies—respect for their time, their life choices, their work product and freedom to show up as themselves. This is a new realm of policies, stated and observed. Smart brands know that how customers get to feel starts with how employees feel at work.”

“Companies that thrived through the Pandemic and beyond have recognized the vital need to put employee well-being and experience at the center of company culture,” says Badzin. “We will see a dramatic shift away from ‘perks’ like unlimited free snacks, in-office massage and ping-pong tables. Employees are showing with their choices that they want a company that has respect-driven policies—respect for their time, their life choices, their work product and freedom to show up as themselves. This is a new realm of policies, stated and observed. Smart brands know that how customers get to feel starts with how employees feel at work.”

Fostering a company culture that connects employees to the organization is also an opportunity for a business to live its brand values.

The pandemic has complicated the growth of company culture and its value proposition, and what that means during the Great Resignation. Promotional products businesses are still working to understand what that means in terms of culture and retention. Badzin suggests companies lean into these changes.

“Many highly skilled employees got a taste of the freelancer or entrepreneur lifestyle with work from home time,” she says. “Now they want to feel like partners or collaborators, with autonomy and a focus on results, skills and creative solutions rather than a clock-in culture.”